Our Process

Knight Wealth Advisors has Knight Wealth Advisors’ processes define our financial planning approach.

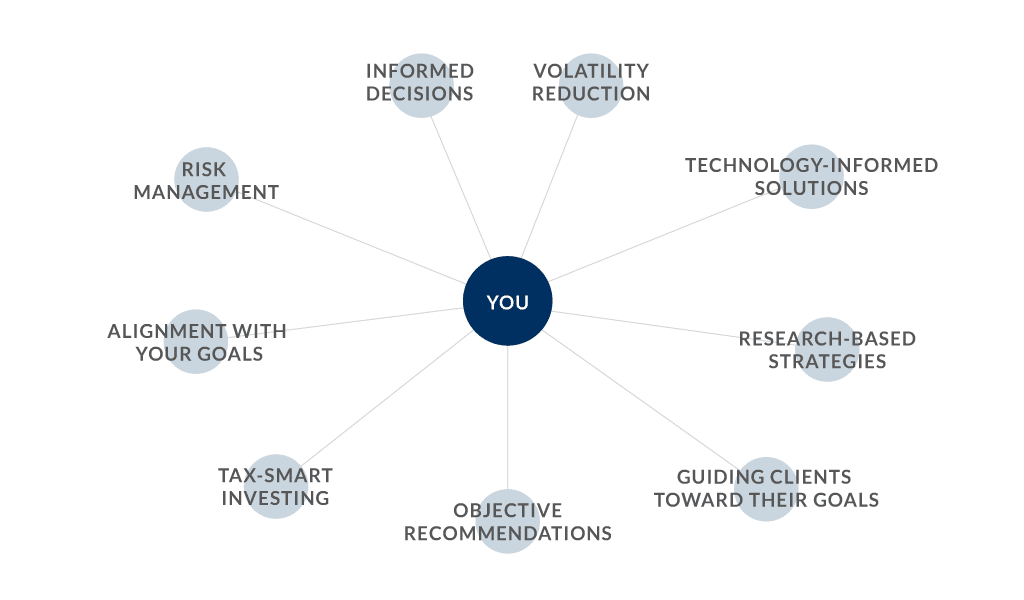

Our approach centers on You!

Our investment process is designed to help clients reach their goals. We work with you to create strategies that fit your lifestyle. The following principles guide our decisions as we develop and implement your personalized plan.

Our Guiding Principles

Financial planning can be a complex topic and is different for each individual and family. Knight Wealth Advisors has developed guiding principles to help you navigate financial matters so you can live well and leave a legacy for the next generation.

The KWA Process

KWA follows a consistent and dynamic investment process:

Discover

- Get to know you and your family

- Understand your goals, obstacles, and preferences

- Gather documentation

- Determine potential risks

Propose

- Introduce our investment philosophy

- Explain the investment process

- Understand what you own and why you own it

- Define risk and show our tools to manage it

Implement

- Transition your current investments into our processes

- Determine which risk management tools we need to use

- Prioritize implementation of risk management tools

- Establish links to outside resources

- Set up communication channels

- Provide training on technology to make your life simpler and more organized

Review

- Review progress toward the action plan designed for you in an annual progress meeting

- Adjust investments in accordance with our process

- Maintain a dialog about important life changes

- Help you navigate your financial journey

All our processes can be summed up as

People Serving People.

We invite you to experience the Knight Wealth Advisors difference.

Services We Provide

Stages of Financial Planning

84 Plantation Dr.

Paducah, KY 42001

Get Directions →

Monday - Friday

8:00AM - 4:00PM

Securities offered through Raymond James Financial Services, Incl, Member FINRA/SIPC. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Knight Wealth Advisors is not a registered broker/dealer and is independent of Raymond James Financial Services

Raymond James financial advisors may only conduct business with residents of states and/or jurisdictions for which the are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for he content of any website or the collection or use of information regarding any website’s users and/or members.

© 2022 Securities offered through Raymond James Financial Services, Inc. member FINRA/SIPC | Legal Disclosures | Privacy, Security & Account Protection | Terms of Use